N.B. - this was first posted on the 20th of January 2025. I recently noticed that I had mischaracterised the DESNZ cost estimates from the 2023 report, so I have edited the original content to correct for this (15th March 2025) Details of the changes will be logged in the appendix.

This will likely be the final detailed piece I write on offshore wind for a few months. Having been impressed by recent trends in capital costs, encouraged by improving capacity factors, horrified by ROC’s and respectful of CFD’s, I turn to operating costs.

I am trying to analyse energy in the UK to help improve policy. None of the content should be construed as investment advice. I have done my best to ensure that the content below is accurate – but I am human and will make mistakes – if you spot any, please let me know and I shall update as appropriate.

Operating Costs - What?

In using the term “Operating Costs” I mean the day-to-day cash costs of running a wind farm - things like maintenance, insurance, transmission costs, accounting and audit fees.

Actually, my mini list above is papering over my ignorance - I don’t really know what comprises the day-to-day costs. To me and my excel spreadsheet, operating costs have an accounting based definition - a series of numbers annoyingly deprived of their proper context.

Put simply (with more details in the appendix) I went through my usual list of 37 UK offshore wind farms1 and their annual reports from Companies House and added together Cost of Goods Sold and Administrative Expenses from the income statement and then deducted Depreciation charges (with the relevant adjustments for IFRS 16 leases) This gave me a cash operating cost for each year for each wind farm.

It’s my best estimate of what each wind farm spent in cash terms each year. Please note this excludes any capital additions. I’m not claiming that my method is perfect - accounting is but a lens with which to view economic reality. I would love to have more detail - to break the costs down into “fixed” and “variable” and know what they all were, but I don’t.

Operating Costs - Why?

The annual cash cost in keeping a wind farm running and delivering power to the grid is clearly an important driver of its long-term economics, but operating costs matter in numerous ways. They matter to longevity - if a wind farms cash costs were higher than its revenues, it might be decommissioned and exit the market. One of my key tasks from this piece is to try and work out what will happen to UK offshore wind farms that start exiting the ROC support mechanism from 2027.

I also want to look at trends in costs over time. Do operating costs rise over time as older kit needs more maintenance? Or do costs stabilise or decline once a wind farm has ironed out early teething problems?

What impact does turbine size have? Do larger turbines mean lower costs per MWh produced?

And finally, what do others think of the future? My work on capital costs and capacity factors interrogated the assumptions from DESNZ - I found their assumptions reasonable with respect to the capital costs, but optimistic when it came to capacity factor forecasts. What are they assuming about operating costs?

Now let us look at the data:

The first graph sets the scene. For each wind farm, I have divided the cash operating costs (inflation adjusted to 2023 values) by the MWh of electricity generated and taken a weighted average across the UK offshore wind fleet.

It’s not a particularly helpful graph as it is aggregating a lot of different trends - for example it doesn’t allow us to look at the impact of ageing upon wind farms, or to see if newer, larger turbines have low operating costs. In addition, there are changes to cost structure that change over time:

Wind Variation: Years like 2015 and 2020 were particularly windy, whereas 2021 was fairly calm - we can see the cost per MWh trend drop in 2015 and 2020 which will have benefited from fixed costs and windier conditions.

Disposal of OFTO assets: Most of the wind farms studied disposed of their transmission assets at some point. When the disposal is made, cash costs should mechanically increase as the wind farm now has to pay a third party for transmission.

Timing of maintenance spending: If wind farms have some discretion over when they undertake maintenance, the trends could be impacted by electricity prices (for those on ROC’s) - e.g. in a high price environment you might be incentivised to spend more to keep the wind farm in perfect condition to maximise output.

Changes to BSUoS charges: Balancing Services use of System charges pay for the cost of balancing power across the GB electricity network. These used to be split broadly equally between larger generators (above 100MW) and suppliers. In April 2023 this changed, with all of the cost recovery coming from suppliers. The underlying economics haven’t really shifted, in that the consumer still ends up paying for the cost of balancing, but it is very likely that it will have reduced reported costs in 2023 for much of my wind farm sample. Not only does this impact the time series (i.e. 2023 should have lower costs vs 2022) but in the historic years, the data will bias towards smaller generators that didn’t pay the charge. 13 of my 37 wind farms were under 100MW.

How do costs change over time?

To get a sense of costs over time, I want to isolate some of the earlier wind farms and examine their cost trends. I started by looking at wind farms with at least 15 years of data or were fully operational before December 2008. This gives me a sample of 7 wind farms.

To try and get a sense of trend in costs per MWh, I plotted the data by wind farm year rather than calendar year, and then took a simple average and median of the group. Whilst its a noisy graph, it suggests that costs were pretty low and rising for the first 5 years, but then appeared to plateau in real terms. (All cost data is inflation adjusted to 2023 values)

Whilst its a noisy data set, I think that only one of these seven wind farms disposed of its transmission assets so that shouldn’t skew the data too much.

I then repeated the exercise for 13 wind farms with 10-14 years of operational data to see if the same relationship held. Offshore transmission assets are a bigger issue here, with 10 of the 13 making disposals. Luckily this effect should have washed out by year 3 in 9 of the 10 cases.

Unfortunately, this appears to be an even noisier data set. The average and median does suggest a similar pattern of a lower initial cost trend up to about year 5, then some stabilisation but the difference is much less extreme than the prior sample. I’m not comfortable drawing any solid conclusions.

However, I do feel comfortable arguing that I haven’t seen any evidence of falling operating costs as wind farms age. Equally when I am looking at larger (and newer) wind turbine sizes, I should bear in mind that they may have a “newness” cost advantage in the early years.

What difference does turbine size make?

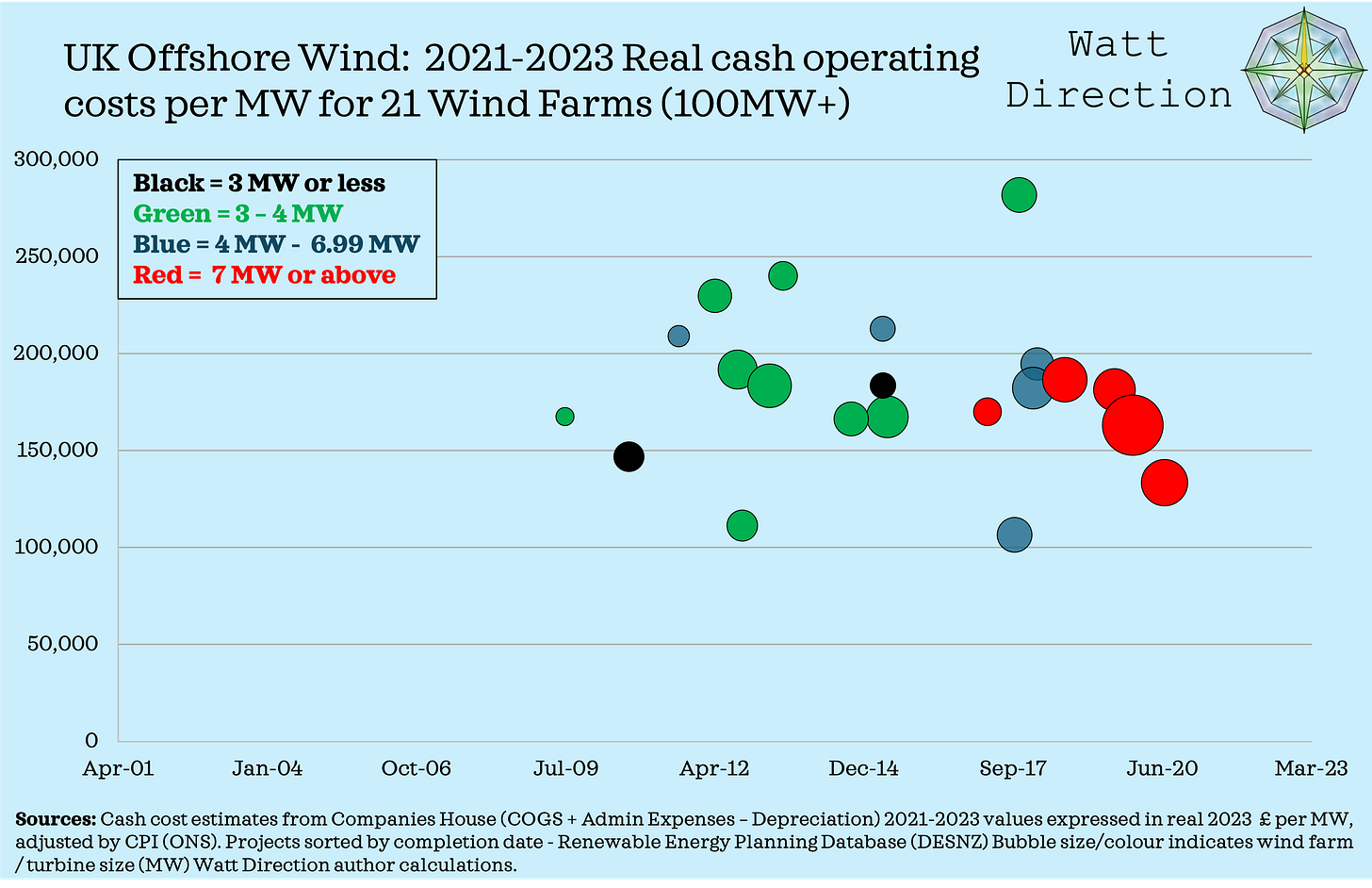

To assess the impact of larger wind turbines, I have calculated the average cash operating cost per MWh for the years 2021, 2022 & 2023 for each wind farm where the data is available. The graph below plots each wind farm, with bubble colour indicating turbine size and bubble size indicating the size of the wind farm.

The trend in the larger turbine groups in blue and red appears to look positive - but equally these are newer turbines and might benefit from lower costs in their first few years of operation.

I can display the data differently - instead of looking at cash operating costs per MWh of power generated, I can compare those same costs to the MW of capacity instead. My previous work on capacity factors suggested that the more recent, larger turbine wind farms were operating at higher capacity factors. By looking at costs per MW of capacity, I can strip out the benefit that was due to improved capacity factor. Admittedly the units used are less intuitive.

Some of the more recent red dots continue to look favourable on this basis, but a major improvement isn’t jumping out at me, especially when I haven’t made the requisite adjustments for wind farm age, offshore transmission disposals and BSUoS charges.

I’m going to re-run the second bubble chart removing all wind farms under 100MW in size. This will get rid of half of the wind farms in the smaller two categories, but should remove the distortion from BSUoS charges. (Only generators larger than 100MW paid these charges prior to April 2023)

This does look a little better and I have included a table below, which splits the turbine sizes into three categories.

Certainly both the costs per MWh and per MW are improving with turbine size - however I’m unsure how much of this might due to turbine size and how much might be associated with turbines earlier in their life.

I wanted a more conclusive answer! I think there are probably some advantages with respect to greater turbine size, but I think I need to wait for more data. 2024 data should be particularly helpful, as it should put the whole data set on a level playing field with respect to BSUoS charges.

What of the future?

My conclusions have been hesitant and I think forecasting future cost profiles is a difficult task. Even though I would struggle to make those forecasts myself, I am happy to be an armchair judge of other people’s assumptions!

I have found two sets of UK government forecasts for offshore wind:

Electricity Generation Costs 2020 published by the Department for Business, Energy & Industrial Strategy (BEIS)

Electricity Generation Costs 2023 published by the Department for Energy Security & Net Zero (DESNZ)

The government forecasts both fixed cost elements (within the annex, split into operations & maintenance, insurance and balancing/connections costs) expressed in £ per MW and a variable cost element expressed in £ per MWh. I have taken both types of costs and used BEIS/DESNZ load factor assumptions to make a single cost item for projects commencing in 2025 and 2030 respectively. For the 2020 data their appears to be a small contradiction between the technical assumptions spreadsheet and the written report with respect to variable costs - I have used the former.

The 2023 paper assumes costs around £110,000 per MW and about £20 per MWh for projects commissioning over the next few years (Inflation adjusted to 2023 numbers)

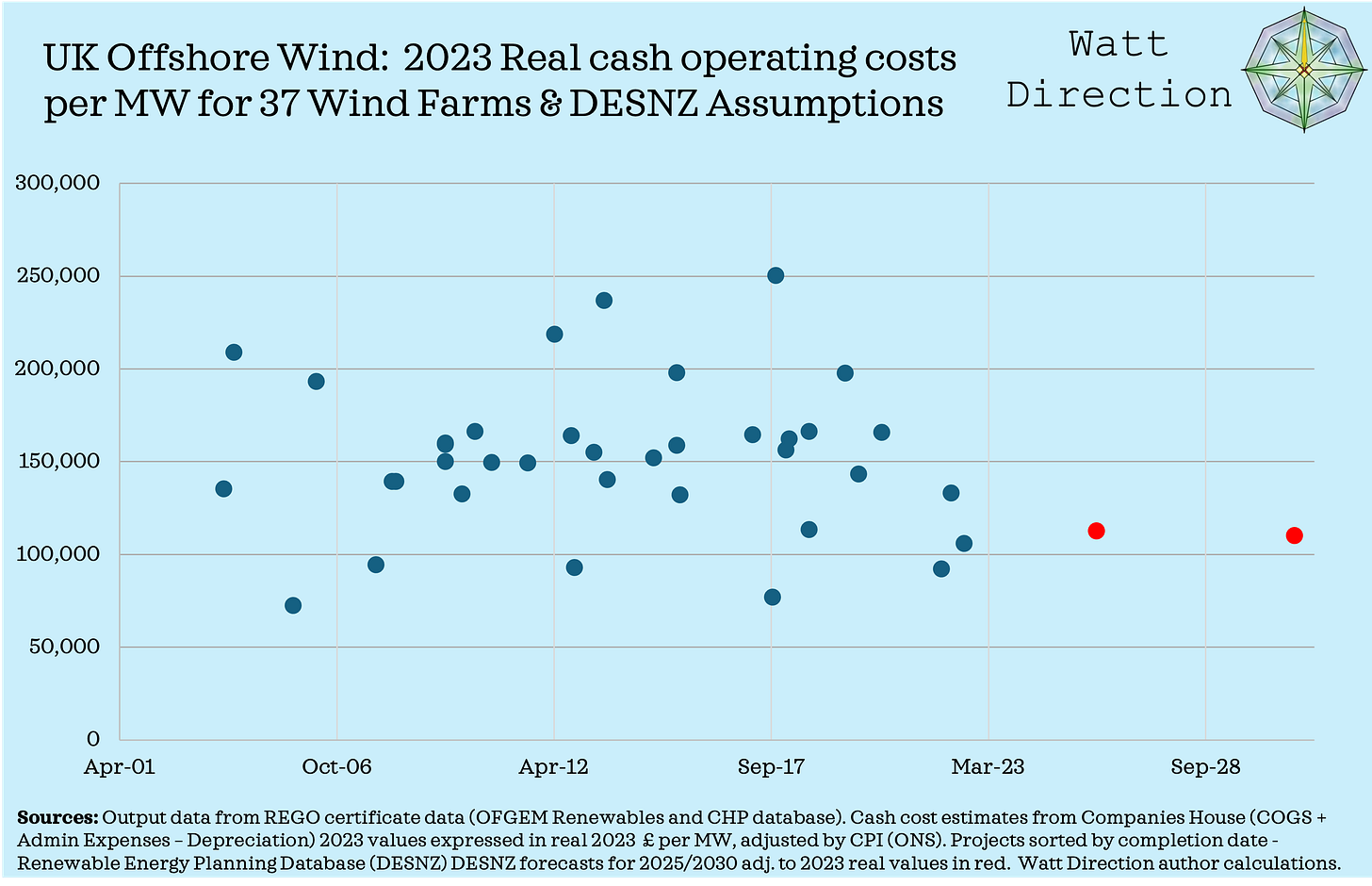

Its possible that my numbers aren’t like-for-like with the DESNZ approach. But I have plotted the 2023 cash operating costs for my 37 wind farms on both a £ per MWh and £ per MW in the following two graphs. I have also included (in red) the forecasts from the 2023 DESNZ paper.

On a £ per MWh basis, the 2025 and 2030 DESNZ assumptions look like a bit of a stretch but perhaps plausible. Part of the difference is because DESNZ are assuming 61% and 65% capacity factors for 2025 / 2030 projects which I think are very optimistic assumptions.

The £ per MW chart looks more plausible, and suggests that it is the punchy capacity factor assumption that appears to be driving the optimistic costs on a per MWh basis. The government is assuming turbines of nearly twice the power output of the three most recent projects in my data set (DESNZ are assuming 14 MW/17MW for 2025/2030 projects) and future years will benefit from a complete removal of BSUoS charges (There were 3 months of charges in 2023)

It will be interesting to watch how this plays out - offshore wind farms with 14MW turbines are being built as I type, with completion expected in the 2025-2026 timeframe.

What will happen to wind farms with expiring ROC’s?

I said at the start of this article that I wanted to try and work out what might happen to earlier wind farms that have ROC’s expiring from 2027. I’m going to try and lay out a framework with respect to 7 wind farms where I think their ROC’s will expire somewhere around 2027 (My estimates rather than exact dates)

They aren’t huge wind farms - totalling around 600MW, and all are under 100MW - but its a good chance for me to make a prediction or at least a framework and then see how that measures up versus reality.

The cash operating costs of the 7 wind farm group averaged about £57 from 2021-2023 (2023 real values) Three of the wind farms had average cash operating costs of £70 or more, three were around the £50 mark, and one was very low at around £25 (which has been a big outlier through my data set)

My framework won’t be a neat falsifiable prediction, as the power price is a key variable. Assuming stable nominal wholesale prices around the £75 mark in 2027 (guess) I think that wind farms will have lower capture rates, due to correlated production - perhaps an achieved price of £60-£65 (c. 80-85% capture, guess)

If that scenario played out, three of the wind farms would be cash flow negative and another 3 very marginal. Thus I think that those 6 wind farms have three rational options:

Decommission - take the wind farm down and leave the market

Cut maintenance spending to reduce costs - and accept output degradation - a similar phenomenon has been noted in US onshore wind when tax credits expire.2

Re-powering - much more below

In Jan 2024 DESNZ published a document entitled “Consultation on proposed amendments for Allocation Round 7 and future rounds” which set out the governments proposed changes to CFD Allocation Round 7. One of the key proposals was the introduction of re-powering - allowing an end of life project to bid for a CFD in order to fully re-power (i.e. replace capital equipment and give it a new lease of life)

Page 49 of this document deals with the proposed eligibility criteria for offshore wind. One of the criteria for all technologies is that projects must have reached the end of their operating lives, which is assumed to be 30 years for offshore wind. Thus, with the first offshore wind projects operational from c. 2003/2004, I quote the following from page 49:

“Initial analysis suggests the first project that could be eligible for repowering under these criteria would be in around 2033”

Which wouldn’t make re-powering relevant for my 7 wind farms in the near term. However a second document appeared in October 2024 entitled “Government response to the consultation on policy considerations for future rounds of the Contracts for Difference scheme”.

There appears to be a key change to the timing element of eligibility:

Page 13: “Projects must have at least reached the end of their operating life by/before the end of the applicable Delivery Year in the next allocation round and not be in receipt of any other subsidy for electricity generation at that point”

I read this as the project being eligible as long as end of operating life is reached by or before the delivery year (when re-powering is complete) Unless I am mistaken this means re-powering work can be started before end of life, as long as the 30 year mark is reached by the point of delivery for the re-powered project.

With respect to offshore wind, if re-powering was to take 2 years (guess) then some of these 7 wind farms might be eligible to start work on re-powering around 2031.

Thus, I think the rational path for an offshore wind farm with a 2027 ROC expiry is:

Minimise cash maintenance spend once the ROC has expired

Stay as a merchant generator for c. 3-4 years

Bid for a re-powering CFD and if successful, start decommissioning and re-powering work somewhere around 2031.

I have mixed views on this:

Positives:

This is a sensible way of making sure that sites with existing transmission infrastructure and permits can continue to operate and even be upgraded, delivering more power from the site.

Consumers will likely continue to benefit from some years of low price merchant generation at the tail of ROC and CFD contracts.

CFD’s are a better contract structure than ROC’s. Re-powering bids might come in at low prices vs complete new builds.

Negatives:

It removes a source of upside to the consumer. If the operating lives of wind farms had been better than expected, consumers would previously have benefited from a long tail of cheap, merchant generation.

It shortens the merchant generation period - in the case of offshore wind with a 30 year operating life and under a CFD, you would have expected 15 years of CFD generation and 15 years of merchant. If decommissioning and repowering takes 2 years and can start pre end of life, this means 2 years less merchant generation than I had previously anticipated.

My slight concern is that we might be witnessing the rise of the permasubsidy or permaCFD. As the scale of wind continues to increase, merchant generation is likely to become increasingly tough, as capture rates will likely decrease over time - but that strays into the realm of another post!

Thanks for reading!

Appendix: My key method to calculate cash operating costs was adding Cost of Goods Sold and Administrative Expenses together, and then deducting depreciation (including decommissioning asset depreciation but excluding IFRS16 depreciation post 2019) I also included the lease expense costs that went through finance expenses.

Potential flaws:

Sometimes grant benefits weren’t stripped out if they were a positive offset to admin expenses

Some wind farms had amortisation charges that I didn’t add back

Treatment of impairments can be inconsistent - included it when its part of COGS or Admin Expense but generally excluded if a separate line item

Some years with offshore transmission disposals treat the disposal proceeds as revenue. In these cases I had to assume revenue = COGS with respect to the transmission assets.

Correction and changes: 15th March 2025

I recently went back to the technical assumptions annex for the 2023 report and noticed that I had mischaracterised the DESNZ position with respect to operating costs. I had only included the variable costs and fixed operating and maintenance costs within my table (as per the below) as these were the only costs mentioned in the report itself. The technical assumptions annex also showed an insurance cost line and a connection/balancing cost line, which I had missed. I have corrected the table in the article above, updated the costs per MWh and MW graphs to show the DESNZ position more accurately and made my description of the DESNZ costs forecasts more balanced. I apologise for the oversight.

Fully commissioned wind farms over 50MW on Crown Estate September 2023 project listings: https://www.thecrownestate.co.uk/media/3954/offshore-wind-project-listing.pdf

Sofia D. Hamilton, Dev Millstein, Mark Bolinger, Ryan Wiser, Seongeun Jeong, How Does Wind Project Performance Change with Age in the United States?, Joule, Volume 4, Issue 5, 2020, Pages 1004-1020

Agree, absurd assumptions by regulators, low 40% realistic and probably optimistic for future projects as best locations taken. The article is very helpful as the common renewables assumptions are that it’s all about capital—but these are very significant operating costs.

Absurd load factor assumption by DESNZ, in real world it has never been above low 40s, sometimes mid, 65% assumption is lunacy